New York State Mileage Reimbursement 2024 Rate – 2024, and reduce the capital portion of nursing home rates by 10%. The bill would also amend the New York State residency requirements for a veteran seeking admission to a state-run Veterans Home . Each correlates with a bracket of income, with the highest rate applying to taxable incomes greater than $25 million. “In general, New York’s state income tax system can be considered relatively .

New York State Mileage Reimbursement 2024 Rate

Source : www.mileagewise.comThe 2024 Guide To Mileage Reimbursements By State | Payhawk

Source : payhawk.comNew York State Society of Enrolled Agents

Source : www.facebook.comIRS Announces Increased Business Mileage Rate for 2024

Source : www.driversnote.comPatch & FitzGerald, PA | Manchester NH

Source : www.facebook.comDow tumbles more than 500 points as hot inflation data stokes

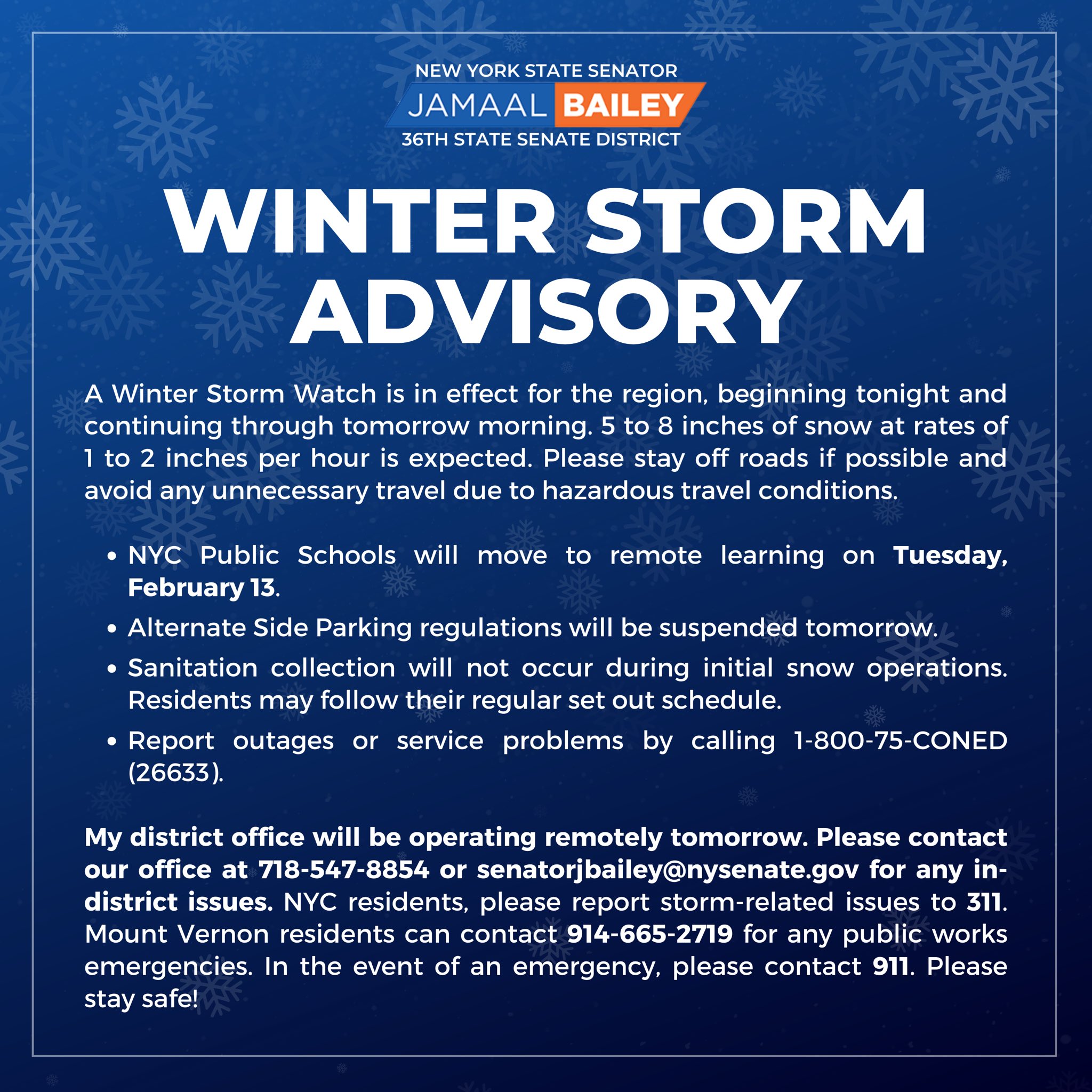

Source : www.cnn.comJamaal T. Bailey on X: “Winter Storm Advisory❄️: We are

Source : twitter.comMedical Mileage Deduction | What’s 2024’s Medical Mileage Rate?

Source : triplogmileage.comNYS Minimum Wage in 2024 | EBC Payroll & HR Resources

Source : www.ebchcm.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgNew York State Mileage Reimbursement 2024 Rate IRS 2024 Mileage Rates: Key Changes and Their Impact on Your Wallet: New York taxpayers cut disgraced ex-Gov. Andrew Cuomo a check for over half a million dollars this week as reimbursement for his legal fees. The Empire State paid Cuomo’s campaign $564,918 this . New York is poised to become the seventh-worst state in the US to take up retirement in 2024, according to a recent where the average effective property tax rate is 2.49%, according to .

]]>